Viridien Reports Strong Q3 and 9M 2024 Financial Results

Viridien Announces its Q3 and 9 Months 2024 Results

Delivering on cash generation and financial roadmap on track to hit our full year target.

Financial Highlights

- Q3 Revenue: $246m

- 9M Revenue: $778m (-3%)

- Adjusted EBITDA: $98m

- Net Cash-Flow: $10m

- 9M Net Cash-Flow: $34m (vs -$15m in 9M 2023)

CEO Statement

Sophie Zurquiyah, Chief Executive Officer of Viridien, stated:

“Our results since the start of the year demonstrate the strength of our strategic vision, with technology leadership, new business growth, and cash flow all showing significant progress. Geoscience was particularly strong this quarter, leveraging its clear differentiation, best-in-class imaging technology and HPC computing power to achieve a record high order book. In Earth Data, the Laconia project, using our most advanced technology, saw increased prefunding and is continuing to progress well. Sensing & Monitoring is actively implementing its adaptation plan and is on track to achieve in 2025 the expected outcomes in cost reduction and operational flexibility to improve performance across the industry cycles. Lastly, we continue to address our financial roadmap with the implementation of the bond buyback program and looking forward, reaffirm our full-year targets.”

Third Quarter Highlights

- Group Revenue: $219 million

- EBITDA: $71 million

- Net Income: $(10) million

Overall group revenue decline in absence of mega crew in Sensing & Monitoring (SMO, revenue down 50%) compared to Q3 2023. Stable DDE revenue, with very strong momentum at Geoscience (revenue + 32% and order intake +91%). Group adjusted EBITDA of $98M, including -$12M penalty fees from vessel commitment. DDE Adjusted EBITDA of $108 million, up 5% thanks to strong Geoscience performance. SMO adjusted EBITDA of $1M (vs $12M).

Net Cash flow of $10 million, including -$18 million contractual fees from vessel commitment. Implementation of the bond buyback program. $25M already bought on the $30M 2024 program as of October 31 (o.w. $12M bought and cancelled as of September 30). Liquidity at $442 million (including $100 million undrawn RCF).

Digital, Data and Energy Transition (DDE)

- Revenue: $187 million, up 1%

- Adjusted EBITDA: $108 million, up 5%

- Geoscience Revenue: $103 million (+32%)

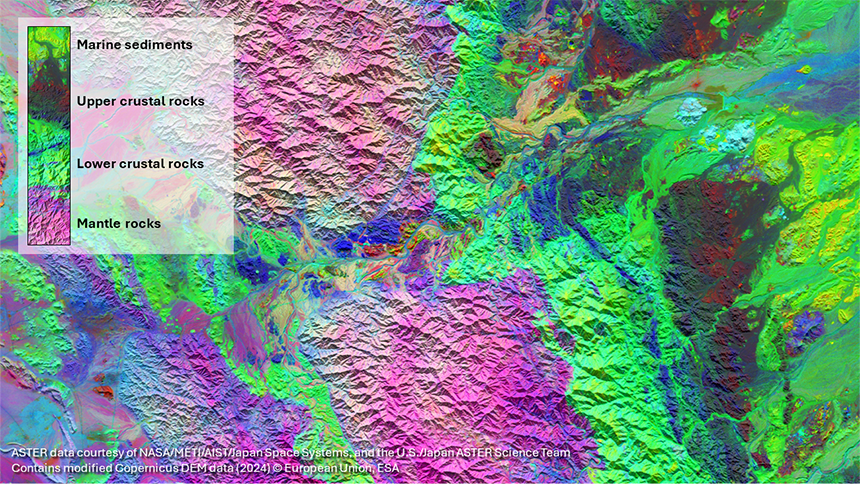

Geoscience performance continues to be driven by technology leadership. Order intake (up 91%) benefits from best-in-class imaging technology, new UK HPC Hub and increased activity in the Middle East. The new businesses confirm positive momentum, both in CCUS with the release of the latest phase of Gulf of Mexico Carbon Storage Study to support upcoming lease rounds and in Minerals & Mining with the award of a sensing program in Oman, to identify, map and rank mineralization prospectivity potential.

Earth Data

- Revenue: $83 million (-22%)

- Prefunding Revenue: $58 million (+4%)

- Weaker After-sales: down 50% at $26 million with unfavorable cut offs

New businesses include revenue from the Norwegian survey for Carbon storage leading to the reprocessing of legacy data in the area.

Sensing and Monitoring (SMO)

- Revenue: $59 million, down 51% across land and marine products

- Adjusted EBITDA: at $1 million (vs $12M)

Transformation plan on track to achieve the expected cost reduction and operational flexibility. New businesses represent 17% of revenue. Delivery of land seismic nodes for large-scale seismic surveys planned in urban areas to target energy resources, including geothermal.

2024 Financial Objectives

The Group reiterates its 2024 financial objectives and confirms its 2024-2025 financial roadmap:

- Revenue expected to be in line with 2023

- EBITDA to be positively impacted by business mix

- Earth Data cash Capex expected at $230-250M

- Net Cash Flow to reach similar level as 2023

No Comments have been Posted.